One of the best tools I have found for keeping on track of my financial goals is the quarterly review. I have probably been doing this for over a decade. For many years, I also did a monthly budget review, which I recommend if you feel somewhat out of control with your personal finances and spending.

There are 5 parts to the monthly review:

- Review income and spending. You will need a record keeping system to monitor this on an ongoing basis. You can use mint.com, YNAB, quicken, or excel. The goal here is to make sure you have an accurate sense of what is coming in and what is going out. Are there any unauthorized charges or unexpected expenses? Are there things you regret having purchased? Do you need to make changes? A great question from the book Your Money or Your Life is “Did I receive fulfillment, satisfaction and value in proportion to what was spent?” If the answer is yes, awesome! If the answer is no, don’t beat yourself up, but do adjust going forward.

- Calculate the amount of passive income you can expect from your investments outside of orthodontics. For some, that will be real estate rents, dividends from privately held investments, distributions from trusts or pensions, etc. For most, however, that will mean from your portfolio of publicly traded stocks and bonds. You could also include the after debt and tax value of your practice. I take that amount and divide it by 25, which is a 4% annual withdrawal rate (Yes, I am aware that 4% is highly disputed). Then I divide by 12 to get a monthly amount I could reasonably expect to live on using my investments. If you are just getting started, this number will be very small, but will grow over time.

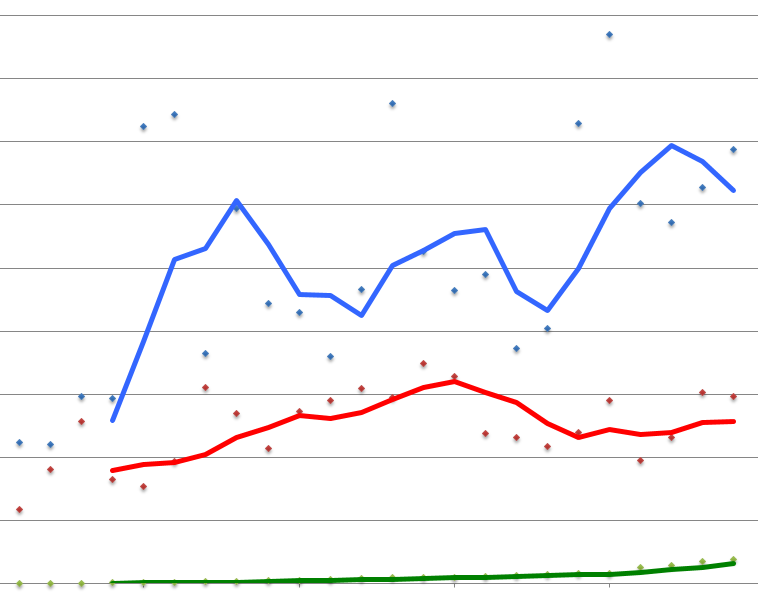

- I add the income (blue), spending (red), and passive income (green) numbers to a chart like the one you see above, which tracks my progress towards financial independence. Obviously I want to see that my expenses over time are less than my income. The gap between them is the fuel for building wealth. I also want to see my expected passive income line creep up over time. When the amount I can expect from passive income exceeds my expenses, I will be financially independent.

- I review my annual financial goals, which will be covered in another post.

- Each quarter we review certain aspects of our financial life on a rotating basis to make sure we are on top of everything. This includes items like insurance, college savings, retirement planning, etc. I will cover these in more detail in future posts.

By taking the time to review our finances every quarter, I make sure I am making steady progress towards my goals and am not overlooking any critical or weak spots. Give it a try!